This article was originally published in BDO Spotlight - June 2024

Why introduce IFRS 18?

Investors have raised concerns about the comparability of entities’ statement of profit or loss due to a lack of consistency in how financial performance is presented. For example, two entities may have similar operations in a similar industry, but they may present the results of their operations differently.

In response to these and other concerns, the IASB undertook a project to replace IAS 1 with a new IFRS Accounting Standard to increase the comparability of financial performance presented by entities.

On 9 April 2024, the International Accounting Standards Board (‘IASB’) published IFRS 18 Presentation and Disclosure in Financial Statements, a groundbreaking update in financial reporting standards. This new standard is poised to replace IAS 1 Presentation of Financial Statements, becoming the primary source of requirements in IFRS® Accounting Standards for financial statements presentation and disclosure.

Although IFRS 18 brings notable changes to financial statement presentation, it is important to note that not all aspects of IAS 1 undergo revision. Instead, a substantial portion of IAS 1's requirements either find inclusion in IFRS 18 or transition to existing IFRS Accounting Standards such as IAS 8.

What are the main changes introduced by IFRS 18?

- Classification of income and expenses in categories and presentation of newly defined subtotals in the statement of profit or loss

- Disclosure of information on management-defined performance measures

- Enhanced requirements for aggregation and disaggregation of financial information

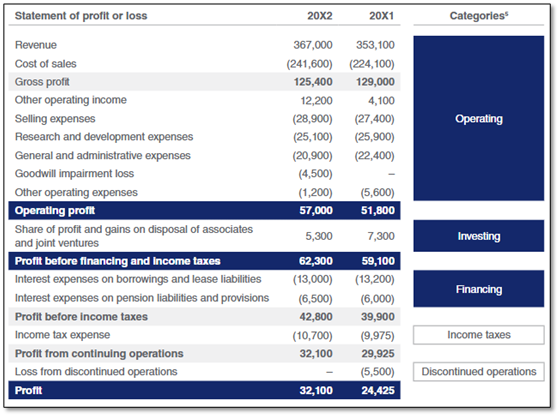

Classification of income and expenses and newly defined subtotals

IFRS 18 requires income and expenses to be classified into five categories:

While IFRS 18 and IAS 7 Statement of Cash Flows do not explicitly align categories used, there are instances where income, expenses, and their associated cash flows may be classified similarly.

Despite the introduction of categories in classifying income and expenses, IFRS 18 also introduces two new mandatory sub-totals:

- Operating profit or loss – sub-total of all income and expenses classified as operating; and

- Profit or loss before financing and income taxes – sub-total of operating profit or loss, and all income and expenses classified as investing.

Figure 1 – Extracted from Figure 3 of Effect Analysis: IFRS 18.

The ‘categories’ column is included in the figure to illustrate the structure of the statement of profit or loss and is not required to be presented in the statement of profit or loss.

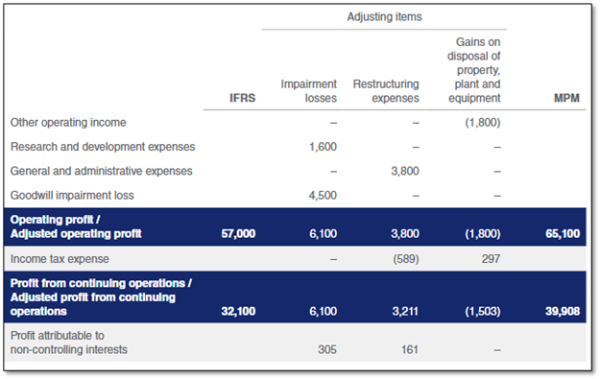

Management-defined performance measures (‘MPM’)

As defined in paragraph 117 of IFRS 18, a management-defined performance measure is a subtotal of income and expenses that:

a) an entity uses in public communications outside financial statements

b) an entity uses to communicate to users of financial statements management’s view of an aspect of the

financial performance of the entity as a whole; and

c) is not listed in paragraph 118, or specifically required to be presented or disclosed by IFRS Accounting

Standards

IFRS 18 requires entities to disclose information about all measures that meet the definition above in a single note and includes:

- A description of why the management-defined performance measure communicates management’s view of an aspect of the entity’s financial performance;

- How the management-defined performance measure is calculated;

- A reconciliation of the most directly comparable total or subtotal specified by IFRS Accounting Standards (e.g. reconcile ‘adjusted operating profit’ to ‘operating profit’ as defined by IFRS 18 and explain the adjustments); and

- The income tax effect and effect on non-controlling interest for each reconciling item disclosed above.

Figure 2 – Extracted from Figure 6 of Effect Analysis: IFRS 18, to illustrate an example of MPM reconciliation.

Aggregation and disaggregation of information

IFRS 18 has stricter requirements regarding aggregation and disaggregation than IAS 1. IFRS 18 requires information to be aggregated based on shared characteristics and to be disaggregated if the resulting information is material.

If an entity does not present such information in the primary financial statements, it shall disclose the information in the notes to the financial statements. Lastly, the aggregation and disaggregation of items shall not obscure material information.

Effective date and transition requirements

The effective date of IFRS 18 is for annual reporting periods beginning on or after 1 January 2027. Comparatives are required to be restated for consistency and comparability in financial reporting. IFRS 18 brings about significant changes to financial statements, requiring adjustments to current reporting systems and processes.

Therefore, the transition to IFRS 18 will likely involve careful planning and implementation efforts by entities to ensure a smooth transition and compliance with the revised presentation and disclosure requirements. Early preparation and assessment of the impact of the new standard on financial reporting processes will be essential for entities to meet the effective date requirements and fulfil their reporting obligations under IFRS Accounting Standards.

How can we assist you?

Feel free to contact our Financial Reporting Advisory Team for further assistance.

Aileen Yap, Director, Knowledge & Professional Development

Ng Kian Hui, Audit Partner & Head of Audit & Assurance